Annual Rates

Based on the results of recent annual actuarial valuations of FPPA Plans, the FPPA Board of Directors approved the following:

SRA Allocation Rates

SRA Defined: An SRA allocation may be made yearly depending on whether contributions payable to a plan within the FPPA Defined Benefit System (with the exception of the Statewide Hybrid Plan - see paragraph below) exceed the cost of funding the plan’s defined benefits. Any excess may be allocated from employer contributions to an SRA account in each member’s name. The SRA is available for distribution upon approval for a normal, vested, early or deferred retirement. This account is in addition to a retirement pension.

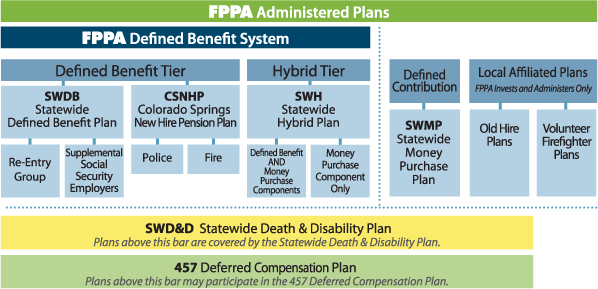

FPPA Defined Benefit System

Statewide Defined Benefit Plan

The SRA rate for the Statewide Defined Benefit Plan is 0%. This SRA contribution rate went into effect July 1, 2018. The Board concluded that the entire required contribution rate from members and employers should be allocated to the actuarial account in order to ensure appropriate funding of the Plan’s defined benefits and to provide funding for the likelihood of future benefit adjustments.

- Reentry Members to the Statewide Defined Benefit Plan

The reentry SRA for those members of a money purchase plan who reentered the Statewide Defined Benefit System is 3.7%. The reentry SRA contribution rate went into effect July 1, 2018. - Social Security Supplemental Plan

The SRA rate for the Social Security Supplemental Retirement Plan is 0%. The SRA contribution rate went into effect July 1, 2018.

Colorado Springs New Hire Pension Plan

The Colorado Springs New Hire Pension Plan became a part of the FPPA Defined Benefit System on October 1, 2006. The SRA rate for members of the Colorado Springs New Hire Pension Plan - Fire & Police Components is currently 0%.

Statewide Hybrid Plan

Excess contributions, if any, to the Statewide Hybrid Plan are made to the member’s Money Purchase Component account and therefore no SRA is awarded.

Contribution Rates

Statewide Death & Disability Plan

For Colorado firefighters and police officers hired on or after January 1, 1997, a percentage of each member’s base salary is required for coverage under the Statewide Death & Disability Plan. The employer, in conjunction with its members, decides who actually pays the contribution.

Based on the 2018 actuarial results the FPPA Board of Directors agreed to increase the Statewide Death & Disability Plan contribution rate from 2.7% to 2.8% effective January 1, 2019 through December 31, 2020. According to Colorado Revised Statute (C.R.S., 31-31-811(4)) contributions may be increased or decreased by 0.1% every two years as determined by the FPPA Board following an actuarial review.

FPPA Defined Benefit System

Statewide Defined Benefit Plan

Contribution rates for the Statewide Defined Benefit Plan are set by state statute. Employer contribution rates can only be amended by state statute. Member contribution rates can be amended by state statute or by election of the membership. Members of this Plan and their employer were contributing 8% of base salary for a total contribution rate of 16% through 2014.

Changes to Member Contributions Through 2022

Members elected in 2014 to increase the member contribution rate beginning in 2015. Member contribution rates are to increase 0.5% annually through 2022 to a total of 12% of base salary. Employer contributions will remain at 8% resulting in a combined contribution rate of 20% in 2022. The member contribution rate for 2018 is 10% and for 2019 is 10.5%. Click here for further explanation about the member election and member contributions.

- Reentry Members to the Statewide Defined Benefit Plan

The contribution rate for members of a money purchase plan who reentered the Statewide Defined Benefit System was set at 20% combined contribution rate from members and employers through 2014. A Member’s contribution may not be less than 8% with the actual split of contributions to be determined by the employer in conjunction with its members.

Changes to Member Contributions Through 2022

Per the 2014 member election, the reentry group will also have their required member contribution rate increase 0.5% annually beginning in 2015 through 2022 for a total combined member and employer contribution rate of 24%. Click here for further explanation about the member election and the impact on member contributions.

- Social Security Supplemental Plan

The contribution rate for members and employers of affiliated social security employers was 4% of base salary for a total contribution rate of 8% effective January 1, 2007 through 2014.

Changes to Member Contributions Through 2022

Per the 2014 member election, the affiliated social security group will also have their required member contribution rate increase 0.25% annually beginning in 2015 through 2022 to a total of 6% of base salary. Employer contributions will remain at 4% resulting in a combined contribution rate of 10% in 2022. The member contribution rate for 2018 is 5% and for 2019 is 5.25%. Click here for further explanation about the member election and the impact on member contributions.

Colorado Springs New Hire Pension Plan - Fire & Police Components

Effective January 1, 2019, the Police Component member contribution rate is 8% of basic salary and the employer remits the remainder of the $8,037,168 annual required contribution.

Effective January 1, 2019, the Fire Component member contribution rate is 10% of basic salary and the employer remits the remainder of the $4,519,669 annual required contribution.

Statewide Hybrid Plan

The mandatory contribution rate for the Statewide Hybrid Plan is 16% of the member’s base salary. Of that 16%, a portion goes towards the Defined Benefit Component and the remainder is contributed to the Money Purchase Component of the Plan. If a department has a higher mandatory contribution rate, any amount above the 16% goes towards the Money Purchase Component of the Plan.

- Defined Benefit & Money Purchase Components

Effective July 1, 2018 the Defined Benefit Component contribution rate is set at 13.4%. After the 13.4% is allocated to the Defined Benefit Component, the remainder of the total contribution rate is then directed to the Money Purchase Component. - Money Purchase Component (ONLY)

The contribution rate for the Statewide Hybrid Plan – Money Purchase Component (ONLY) remains at 16% with the member and employer rates established by the employer’s resolution.

Statewide Money Purchase Plan

The Statewide Money Purchase Plan mandatory combined contribution rate remains set at 16% (8% member and 8% employer).

Benefit Adjustments

Benefit Adjustment Defined: Colorado Revised Statutes provide that benefit adjustments to statewide plans administered by FPPA are to be determined by the FPPA Board of Directors each year (with the exception of Colorado Springs – see below). In the past this adjustment has been referred to as a cost-of-living adjustment or COLA. While cost-of-living percentages from economic indicators, such as the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), are considered by the FPPA Board for setting this adjustment – there are other equally important factors which cannot be defined as cost-of-living. More importantly when making the determination of a benefit adjustment the FPPA Board must determine the amount of benefit increase the plans can sustain to ensure 100% funding of the plans. All of these factors go into the annual Board decision to establish a benefit adjustment.

Statewide Death & Disability Plan

Totally Disabled Members and their Beneficiaries

Under the Statewide Death & Disability Plan, totally disabled members and their beneficiaries are granted a fixed 3% benefit adjustment each year on October 1. Those who retired on or before October 1, 2017 will have their benefit adjusted by this percentage in their October retirement payment.

Occupationally Disabled Members and their Beneficiaries and Survivors of Active Duty Members

Occupationally disabled members and their beneficiaries and survivors of active duty members may be granted a benefit adjustment at the discretion of the FPPA Board of Directors. The Board takes into account many factors when granting a benefit adjustment. One of those factors is maintaining the funded status of the plan to ensure all benefits can be paid. Due to the funded status of the plan, 100.1% as of January 1, 2018, the Board decided that occupationally disabled members, their beneficiaries, and survivors of active duty members will not receive a benefit adjustment in October 2018.

FPPA Defined Benefit System

Statewide Defined Benefit Plan

The Board decided to grant a 0.39% benefit adjustment to the retirees and beneficiaries of the Statewide Defined Benefit Plan for October 2018. Those who retired on or before October 1, 2017 will have their benefit adjusted by this percentage in their October retirement payment. The decision was based on the amount of benefit increase the plan could sustain based on the contributions to the plan and keeping the plan 100% funded.

Statewide Hybrid Plan - Defined Benefit Component

A 3% benefit adjustment will be granted for all retirees and beneficiaries of the Statewide Hybrid Plan – Defined Benefit Component who were retired on or before October 1, 2017. The decision was based on the amount of benefit increase the plan could sustain based on the contributions to the plan and keeping the plan 100% funded. The benefit will be adjusted in the October 2018 retirement payment.

Colorado Springs New Hire Pension Plan

Effective October 1, 2018 the following cost-of-living adjustments will be granted for certain retirees of the Colorado Springs New Hire Pension Plans: Fire Component = 2% and Police Component = 2.5%. The FPPA Board of Directors do not establish benefit adjustments for either Colorado Springs New Hire Pension Plans. For both components of the Colorado Springs New Hire Plan cost-of-living adjustments are directed by their plan documents and are linked to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the previous year.

Governing Board

Governing Documents

FPPA

- About FPPA

- Address & Directions

- Contact Us

- Employment Opportunities

- FPPA Overview

- Glossary of FPPA Terms

- News and Video

- Organizational Chart

- Our Vision & Mission Statement

- Participating Employers (This link will direct you to the Annual Report | Statistical Section.)

- Public Records

- RFP

National Suicide Prevention Lifeline

Are you in a crisis? Struggling emotionally and need to talk to someone?

Call the National Suicide Prevention Lifeline or chat online.

It's free and confidential.

(800) 273-TALK (8255) • suicidepreventionlifeline.org