FPPA Member Contribution Rate Changes, Explained

For Members of the Statewide Defined Benefit Plan

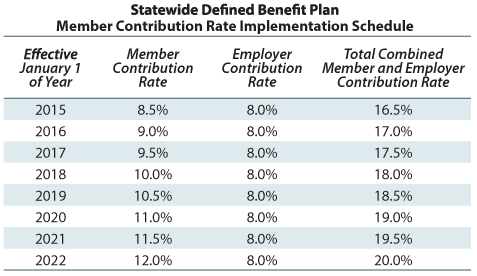

In 2014 Members of the Statewide Defined Benefit Plan (SWDB) voted in favor of increasing the member contribution rate. The increase of .5% per year began in 2015; the new member rate will be fully implemented in 2022 at 12%.

The primary purposes of the added funding are to:

- increase the level of funding which in turn increases the protection against benefit rollbacks in times of economic downturns. This election was the result of several months of study by a task force that included members, consultants and FPPA board and staff members; and

- increase the likelihood that members will receive more meaningful benefit adjustments (a.k.a. COLA’s) in retirement to help their pension keep better pace with inflation.

Click here for a handout of the data found on this page.

Who contributes?

1. What plans will this new Member contribution rate apply to?

It applies to the following:

- Statewide Defined Benefit Plans (SWDB),

- SWDB

- SWDB DROP

- SWDB Reentry Member Group,

- SWDB Reentry Member Group DROP,

- SWDB-SS (DB Plan offered as a supplement to Social Security),

It does NOT apply to the:

- Statewide Hybrid Plan,

- Statewide Hybrid Plan DROP,

- Statewide Money Purchase Plan,

- Statewide Death and Disability Plan,

- Chiefs who opt into another plan.

2. Does this change impact the Employer contribution rate to the plan?

No, the change only applies to the Member contribution rate. The legislation enacted in 2010 permitted members to vote on increasing the member contribution rate. The legislation specifically states that “The increase in the member contribution rate shall not be subject to negotiation for payment by the employer.” An increase in the employer contribution could be considered through additional legislation.

3. Does this rate apply to all Members enrolled in the SWDB Plan, regardless how they voted?

Yes. This change applies to all current and future Members of the SWDB Plan.

Timing

4. When was the new rate effective and how is it applied?

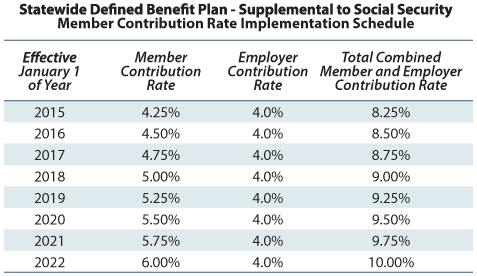

The first Member contribution rate increase went into effect January 1, 2015. The contribution rate increase is phased in over eight years. The actual rates may be found below for the SWDB-Plan, the SWDB-SS Plan and the SWDB Reentry Group.

Calculation

5. Does the salary used in calculating the member contribution rate change?

Member contributions will continue to be calculated on Base Salary.

Base salary means:

- the total base rate of pay including Member Contributions to the Statewide Defined Benefit Plan or Statewide Money Purchase Plan which are “picked up” by the employer, and shall also include:

- longevity pay,

- sick leave pay taken in the normal course of employment,

- vacation leave pay taken in the normal course of employment,

- shift differential,

- and mandatory overtime that is part of the Member’s fixed, periodic compensation

- accumulated vacation leave pay will also be included if a Member completes his or her service requirement for purposes of Normal retirement while exhausting accumulated vacation leave.

Base salary shall not include:

- overtime pay (except as noted in the preceding section),

- step-up pay or other pay for temporarily acting in a higher rank,

- uniform allowances,

- accumulated sick leave pay,

- accumulated vacation leave pay (except as noted in the preceding section),

- and other forms of extra pay (including Member Contributions which are paid by the employer and not deducted from the Member’s salary).

Additionally:

- In the event an employer has established or does establish a Deferred Compensation Plan, the amount of the Member’s salary that is deferred shall be included in the Member’s base salary.

- Any amounts voluntarily contributed to an Internal Revenue Code Section 125 “Cafeteria Plan” shall be included in the Member’s base salary.

- A Member is deemed temporarily acting in a higher rank if the appointment to the rank is anticipated to last less than six months.

Contribution Rates

6. What is the new Member contribution rate for the SWDB Plan?

7. What is the new Member contribution rate for the SWDB Reentry Group?

Reentry members* have an additional rate that was negotiated locally and provided to FPPA by resolution when departments reentered the SWDB Plan. The combined member and employer rate for members of this group was set at 20% prior to this change. The election impacted this group too; the additional ½% per year in the contribution rate is in addition to the Member rate that was negotiated locally at the time of reentry.

*Reentry rates apply only to those members of a reentry department who were active in the plan at the time the reentry took place and who elected to participate in the Statewide Defined Benefit Plan. If you have questions on who this change applies to, please contact the FPPA Contribution Specialist assigned to your account.

Employers with SWDB Reentry Members*

8. What is the Member contribution rate to the SWDB-SS Plan?

Employers with SWDB-SS Reentry Members

DROP

9. Do members participating in the Deferred Retirement Option Plan (DROP) contribute at these rates?

Yes. Members in the DROP program will also remit at the rates - based on the applicable plan chart above.

Governing Board

Governing Documents

FPPA

- About FPPA

- Address & Directions

- Contact Us

- Employment Opportunities

- FPPA Overview

- Glossary of FPPA Terms

- News and Video

- Organizational Chart

- Our Vision & Mission Statement

- Participating Employers (This link will direct you to the Annual Report | Statistical Section.)

- Public Records

- RFP

National Suicide Prevention Lifeline

Are you in a crisis? Struggling emotionally and need to talk to someone?

Call the National Suicide Prevention Lifeline or chat online.

It's free and confidential.

(800) 273-TALK (8255) • suicidepreventionlifeline.org