About FPPA

For a more detailed overview of FPPA refer to the most recent Comprehensive Annual Financial Report.

Our Vision & Mission Statement

Watch "FPPA: Committed to Our Members"

Office Hours

Monday - Friday

8:00 am to 4:30 pm Mountain Time

Address

Fire & Police Pension Association of Colorado

5290 DTC Parkway, Suite 100

Greenwood Village, Colorado 80111

Map

Phone Numbers

(303) 770-3772 (FPPA) in the Denver Metro area or toll free nationwide (800) 332-3772 (FPPA) Fax (303) 771-7622

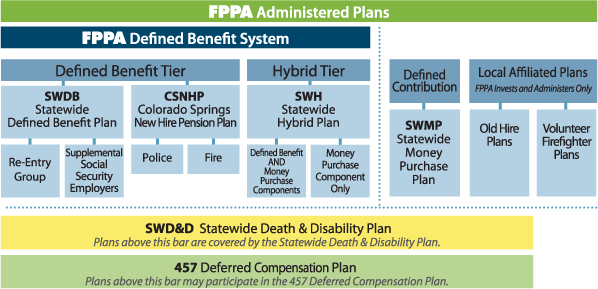

The Fire and Police Pension Association was established January 1, 1980 and administers a statewide multiple employer public employee retirement system providing defined benefit plan coverage (The Statewide Defined Benefit Plan) as well as death and disability coverage (the Statewide Death and Disability Plan) for police officers and firefighters throughout the State of Colorado. The Association also administers local defined benefit pension funds for police officers and firefighters hired prior to April 8, 1978 whose employers have elected to affiliate with the Association and for volunteer fire defined benefit plans. In addition, Colorado police and sheriff departments who participate in Social Security have the option of affiliating for supplemental coverage through the Statewide Defined Benefit Plan and Statewide Death and Disability Plan.

Starting January 1, 1995, the Association began offering membership in the Statewide Money Purchase Plan. Also in 1995, FPPA began offering participation in an IRC 457 Deferred Compensation Plan.

As of January 1, 2004, the Association began offering membership in the Statewide Hybrid Plan (a combination defined benefit and money purchase plan).

Starting January 1, 2006, FPPA added to the Defined Benefit System the Colorado Springs local defined benefit pension plans for firefighter and police employees in the Colorado Springs New Hire Pension Plans. These plans are closed for new members as of January 1, 2006.

Plan Information

The Fire & Police Members' Benefit Investment Fund is established pursuant to Title 31, Article 31, and Part 3 of the Colorado Revised Statutes, as amended. As trustee of the Fire & Police Members’ Benefit Investment Fund, the Fire and Police Pension Association of Colorado (FPPA) collects, invests, administers and disburses monies on behalf of firefighters and police officers throughout the State of Colorado for:

- FPPA Defined Benefit System, consisting of:

- The Statewide Defined Benefit Plan (SWDB), a retirement plan for firefighter and police employees hired in the State of Colorado on or after April 8, 1978 and

- The Statewide Hybrid Plan (SWH), which began operations as of January 1, 2004

- The Colorado Springs New Hire Pension Plan (CSNHPP), consisting of two components, the Fire Component and the Police Component, which were added January 1, 2006

- The Statewide Death and Disability Plan (SWD&D) and

- The Statewide Money Purchase Plan (SWMP), which began operations as of January 1, 1995

Affiliated plans of the Fire & Police Members' Benefit Investment Fund include:

- Local defined benefit pension plans for firefighter and police employees in the State of Colorado hired before April 8, 1978 (old hires) whose employers have chosen to affiliate with FPPA;

- Volunteer firefighter defined benefit pension plans in the State of Colorado who have chosen to affiliate with FPPA.

Each of the pension plans mentioned above has its assets pooled for investment purposes. All transactions that are specific to each plan (contributions, retirement benefit payments, refunds, etc.) are accounted for by plan. The old hire and volunteer plans that have chosen to affiliate with FPPA for investment and administrative purposes are still governed by their local plan document and local pension board, and each has a separate actuarial valuation done every two years. Only the Statewide Defined Benefit Pension Plan, the Statewide Hybrid Plan, the Colorado Springs New Hire Pension Plan, the Statewide Money Purchase Plan, and the Statewide Death and Disability Plan are governed by the FPPA Board of Directors.

FPPA partners with Fidelity Investments to cover the Statewide Money Purchase Plan, 457 Deferred Compensation Plan, Deferred Retirement Option Plan (DROP), and the Money Purchase Component of the Statewide Hybrid Plan.

The following is a brief summary of the basic provisions of the FPPA Defined Benefit System which contains three tiers; the Statewide Defined Benefit Plan, the Statewide Hybrid Plan, and the Colorado Springs New Hire Pension Plan. This summary is provided for informational purposes only. Please refer to the Colorado Revised Statutes, as amended, for more complete information.

FPPA Defined Benefit System

This system contains three tiers which are described below. Also listed are descriptions of the other plan groups that FPPA administers.

Statewide Defined Benefit Plan (Tier of the FPPA Defined Benefit System)

The plan is a cost-sharing multiple-employer defined benefit pension plan covering substantially all full-time employees of participating firefighter or police departments in Colorado hired on or after April 8, 1978 (new hires), provided that they are not already covered by an exempt or withdrawn local pension plan. The plan became effective January 1, 1980. (The SWDB-Supplemental Social Security plan covers members of police or sheriff departments who participate in Social Security, but have chosen to affiliate for supplemental benefits. The SWDB-Supplemental Social Security plan benefits and the contribution rate are ½ of that provided by the full SWDB plan.)

Employers had the option to elect to withdraw from the SWDB Plan until a change in state statute was passed which permitted no further withdrawals after January 1, 1988. With the implementation of the Statewide Hybrid Plan as of January 1, 2004, withdrawn employers may allow members to elect the Statewide Defined Benefit Plan at a higher contribution rate.

The Statewide Defined Benefit Plan has a Deferred Retirement Option Plan (“DROP”) defined contribution provision that is self-directed by the members and record kept by Fidelity Investments. The Plan also has two Stabilization Reserve Account defined contribution provisions that are managed by FPPA.

Statewide Hybrid Plan (Tier of the FPPA Defined Benefit System)

The Statewide Hybrid Plan offers a combination of a Defined Benefit Component and a Money Purchase Component. Active members of the Plan on an effective date of transfer may elect to participate in both Components of the Plan or they may choose only to participate in the Money Purchase Component of the plan. The Statewide Hybrid Plan became effective January 1, 2004. The Statewide Hybrid Plan has a Deferred Retirement Option Plan (“DROP”) defined contribution provision that is self-directed by the members and record kept by Fidelity Investments.

Colorado Springs New Hire Pension Plan (Tier of the FPPA Defined Benefit System)

The two components within the Colorado Springs New Hire Pension Plan are individual defined benefit pension plans covering full-time firefighters and police officers hired on or after April 8, 1978. The plans were added to the FPPA Defined Benefit System as of October 1, 2006 and were closed to new members at that time.

Statewide Death and Disability Plan

The Plan is similar to a self-insured employee welfare benefit plan, covering full-time employees of This plan covers substantially all firefighter and police departments in Colorado. Contributions to the Plan are used for the payment of death and disability benefits.

For covered employees hired prior to January 1, 1997, the Plan is funded by the State of Colorado whose contributions are established by Colorado statute. For covered employees hired on or after January 1, 1997, the Plan is funded through local employer and/or member contributions.

Statewide Money Purchase Plan

The Plan is a multi-employer defined contribution (money purchase) pension fund covering full-time employees of participating fire or police departments in Colorado who have elected to participate in the Plan. The Plan became effective on January 1, 1995. Members self-direct the investment of the assets, FPPA partners with Fidelity, the record-keeper for the plan.

Local Affiliated Old Hire Plans

These plans are individual defined benefit pension plans for firefighter and police employees in the State of Colorado hired before April 8, 1978 (old hires) whose employers have chosen to affiliate with FPPA. The affiliated plans are still governed by their local plan document and local pension board. Each has a separate actuarial valuation done every two years where contributions rates are determined.

Several plans have Deferred Retirement Option Plan (“DROP”) provisions; the investment of the DROP assets is self-directed by the members; Fidelity provides recordkeeping services. One plan has a DROP provision that is managed by FPPA.

Local Affiliated Volunteer Plans

These defined benefit pension plans cover volunteer firefighters in the State of Colorado who have chosen to affiliate with FPPA. Volunteer members are not compensated and do not contribute to their plan. The plans are mostly funded by a mill levy tax. Many of the plans receive State matching funds if they contribute to their volunteer plan. The retirement benefit is generally based on the total assets in the plan. Volunteer plans offer a flat dollar retirement benefit ranging from $0 - $1,400 per month.

457 Deferred Compensation Plan

Additional information on the plans administered by FPPA can be located on this website. Click on the Publications button to view the Comprehensive Annual Financial Report which includes plan, assets, and actuarial information or click on the Benefits button to view plan brochures.

Governing Board

Governing Documents

FPPA

- About FPPA

- Address & Directions

- Contact Us

- Employment Opportunities

- FPPA Overview

- Glossary of FPPA Terms

- News and Video

- Organizational Chart

- Our Vision & Mission Statement

- Participating Employers (This link will direct you to the Annual Report | Statistical Section.)

- Public Records

- RFP

National Suicide Prevention Lifeline

Are you in a crisis? Struggling emotionally and need to talk to someone?

Call the National Suicide Prevention Lifeline or chat online.

It's free and confidential.

(800) 273-TALK (8255) • suicidepreventionlifeline.org