Understanding Your 1099-R Form

1099-R Forms for 2018 Will Be Mailed by January 31, 2019.

Your 1099-R Form will include:

- the total gross distribution,

- the total taxable amount,

- and the total tax withheld,

of your FPPA retirement benefit income.

Before Your Form Arrives

You may view a "data only" version of your 1099-R information on the Member Account Portal (MAP). The "data only" version is NOT a copy you can use for IRS tax filing purposes. It is only a snap-shot of the data you will see on the actual 1099-R Form we will mail to you.

If you have not registered for MAP - it's easy to get started. Just contact an FPPA Retiree Payroll Representative.

Tax Questions? Contact your Tax Advisor.

IRS Questions? Call 800-829-1040 or view the 1099-R webpage at IRS.gov.

Need a Replacement Copy? Contact an FPPA Retiree Payroll Representative.

FPPA Retiree Payroll Representative

Phone: 303-770-3772 in the Denver Metro area or 800-332-3772 toll free nationwide

Phone Ext. 6200

Email: retireepayroll@fppaco.org

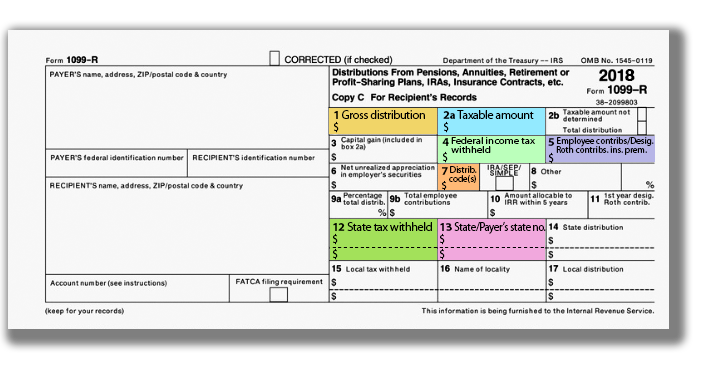

The 1099-R Form above is a sample of what will be mailed to you reporting your FPPA retirement benefit income to the IRS. When your form arrives you will need to use the form to complete your income tax return. We have provided colored boxes above to match the short summaries below. Complete information about each box may be found on the back of the form when it arrives in the mail.

![]() Gross distribution - The total amount paid to you by FPPA for the calendar year.

Gross distribution - The total amount paid to you by FPPA for the calendar year.

![]() Taxable amount - The portion of your total benefit received during the calendar year that should be considered taxable income.

Taxable amount - The portion of your total benefit received during the calendar year that should be considered taxable income.

![]() Federal income tax withheld - The total amount of federal income tax withheld during the calendar year. This box may or may not have a value depending on your withholding election.

Federal income tax withheld - The total amount of federal income tax withheld during the calendar year. This box may or may not have a value depending on your withholding election.

![]() Employee contributions/designated Roth contributions - Difference between Box 1 and Box 2a – the portion of monies excluded from taxable amount – only applies to after-tax funds.

Employee contributions/designated Roth contributions - Difference between Box 1 and Box 2a – the portion of monies excluded from taxable amount – only applies to after-tax funds.

![]() Distribution code(s) - This code identifies the type of benefit being paid (see the back of the 1099-R Form when it arrives in the mail).

Distribution code(s) - This code identifies the type of benefit being paid (see the back of the 1099-R Form when it arrives in the mail).

![]() State tax withheld - The total amount of Colorado income tax withheld during the calendar year - if applicable.

State tax withheld - The total amount of Colorado income tax withheld during the calendar year - if applicable.

![]() State/Payer’s state no. - Colorado State Number - if applicable.

State/Payer’s state no. - Colorado State Number - if applicable.

Governing Board

Governing Documents

FPPA

- About FPPA

- Address & Directions

- Contact Us

- Employment Opportunities

- FPPA Overview

- Glossary of FPPA Terms

- News and Video

- Organizational Chart

- Our Vision & Mission Statement

- Participating Employers (This link will direct you to the Annual Report | Statistical Section.)

- Public Records

- RFP

National Suicide Prevention Lifeline

Are you in a crisis? Struggling emotionally and need to talk to someone?

Call the National Suicide Prevention Lifeline or chat online.

It's free and confidential.

(800) 273-TALK (8255) • suicidepreventionlifeline.org